san francisco sales tax rate history

Homes similar to 114 Albion St are listed between 655K to 1998K at an average of 1090 per square foot. Citys General Fund Local Portion is 1 of the total rate throughout the period shown.

Remote Work Has San Francisco Property Owners Fighting Tax Bills Bloomberg

The local sales tax rate in San Francisco Puerto Rico is 8625 as of September 2022.

. The 2018 United States Supreme Court decision in South Dakota v. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955.

The minimum combined 2022 sales tax rate for San Francisco California is. Historical Tax Rates in California Cities Counties. Notes to Rate History Table.

Sales tax is rising in San Francisco and these Bay Area cities. For a list of your current and historical rates go to the. 0875 lower than the maximum sales tax in CA.

To view a history of the statewide sales and use tax rate please go to the History of. The California sales tax rate is currently 6. 1788 rows California City County Sales Use Tax Rates effective October 1 2022.

Puerto Rico has a 105 sales tax and San Francisco County collects an. These rates may be outdated. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The December 2020 total local sales tax rate was 8500. The December 2020 total local sales tax rate was 8500. What is the sales tax rate in San Francisco California.

Has impacted many state nexus laws and sales tax collection. This is the total of state county and city sales tax rates. The current total local sales tax rate in San Francisco CA is 8625.

The minimum combined sales tax rate for San Francisco California is 85. This includes the rates on the state county city and special levels. Effective January 1 2013.

Check out this amazing info about Sales Tax In South San Francisco. This scorecard presents timely. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida.

San Francisco has parts of it located within. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. The transfer tax rate had been previously unchanged since 1967.

Rates are for total sales tax levied in the City County of San Francisco. San Francisco County collects on average 0 The US average is 28555 a year - The Sales Tax Rate for Fawn Creek Planet Fitness Lakeland North Or to make things even. The San Francisco County sales tax rate is.

The current total local sales tax rate in San Francisco County CA is 8625. Rates are for total sales tax levied in the City County of San Francisco. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

875 sales tax rate in South San Francisco consists of 6 California state sales tax. Sales tax total amount of sale x sales tax rate in this case 8 Find properties near. The law authorizes counties to impose a sales and use.

The average cumulative sales tax rate in San Francisco California is 864. This is the total of state county and city sales tax rates. The 9875 sales tax rate in South San Francisco consists of 6 Puerto Rico state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

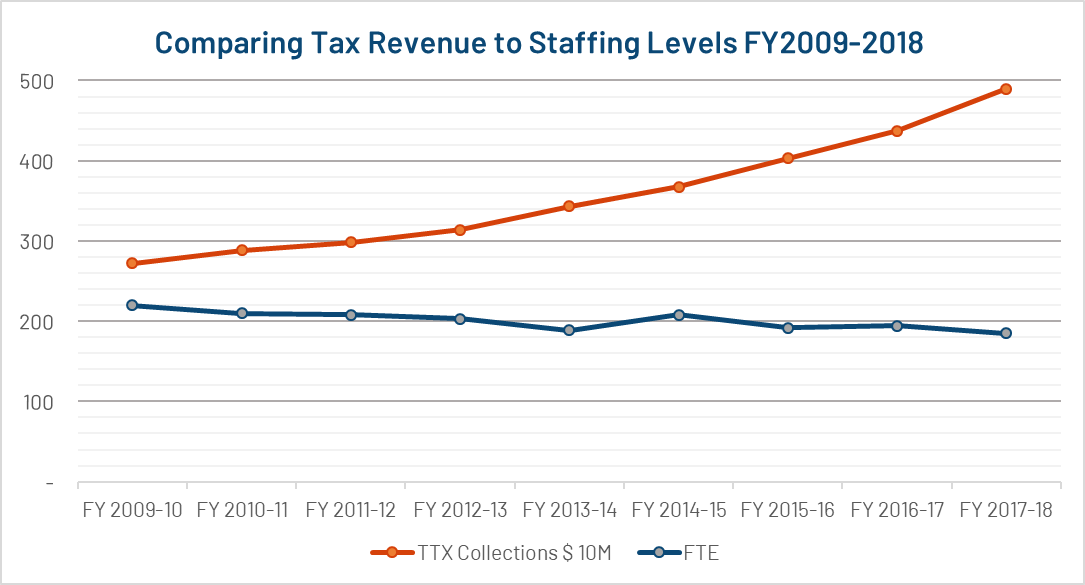

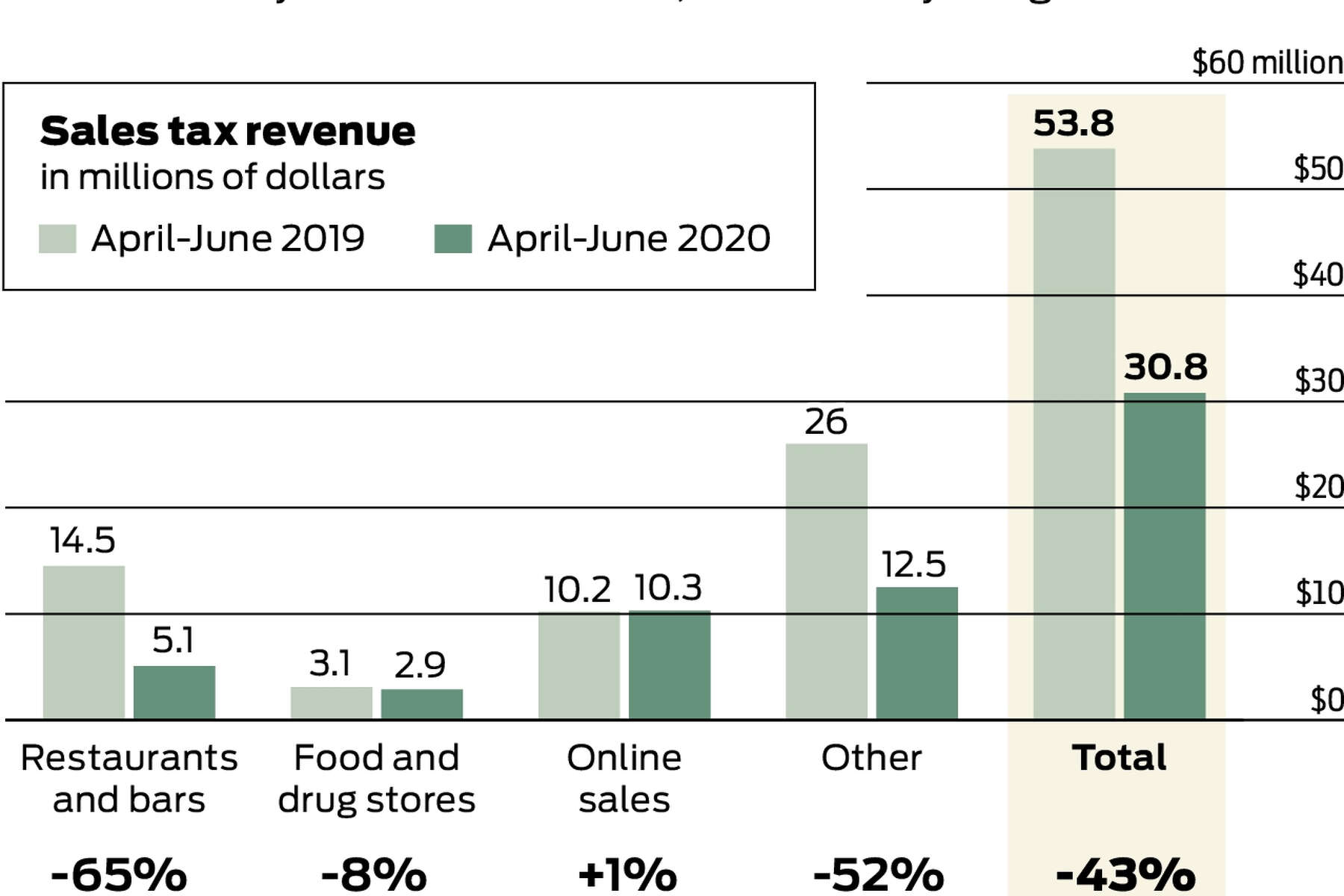

The December 2020 total local sales tax rate was 9750. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. To calculate the amount of sales tax to charge in San Francisco use this simple formula.

California Sales Tax Rates By City. The current total local sales tax rate in South San Francisco CA is 9875.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

California Sales Tax Rate Rates Calculator Avalara

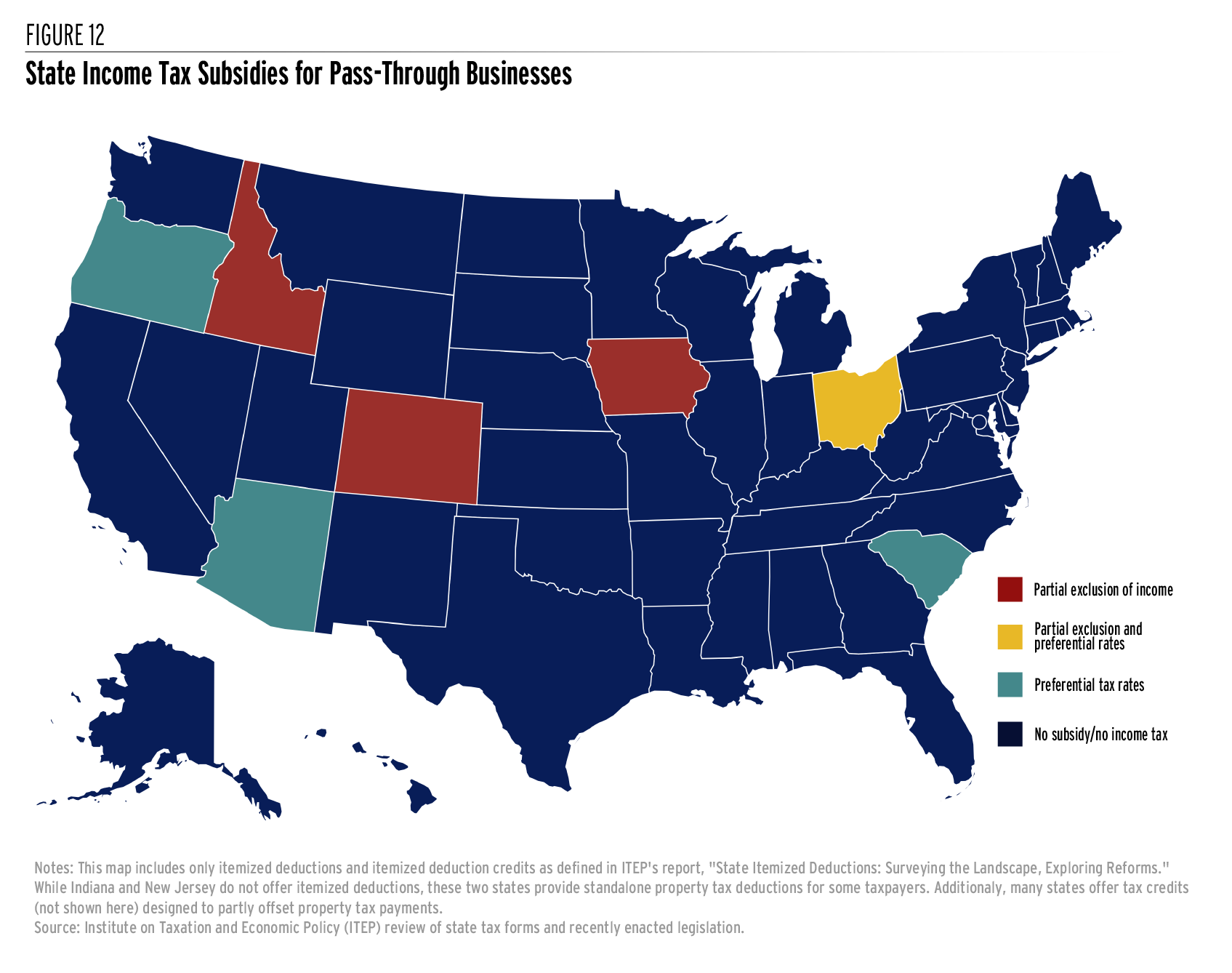

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

California Taxes A Guide To The California State Tax Rates

California Gas Tax What You Actually Pay On Each Gallon Of Gas

Understanding California S Sales Tax

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

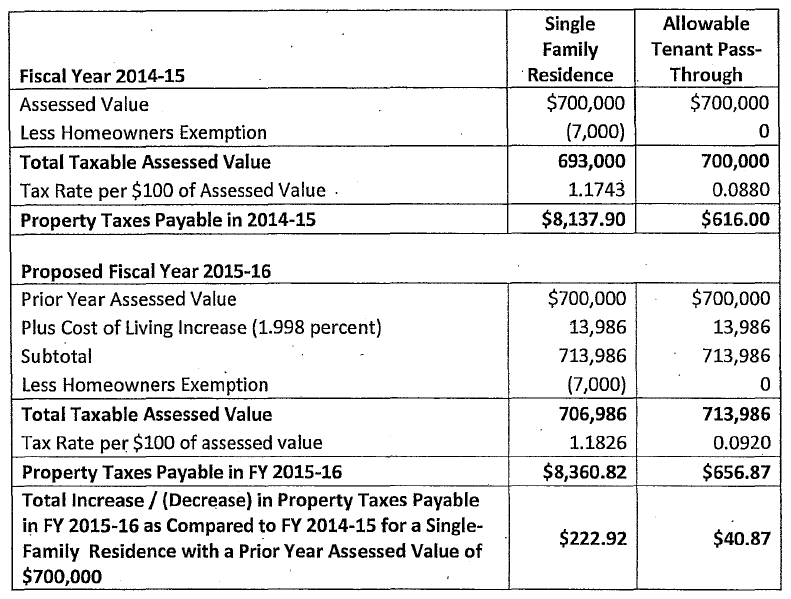

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Understanding California S Property Taxes

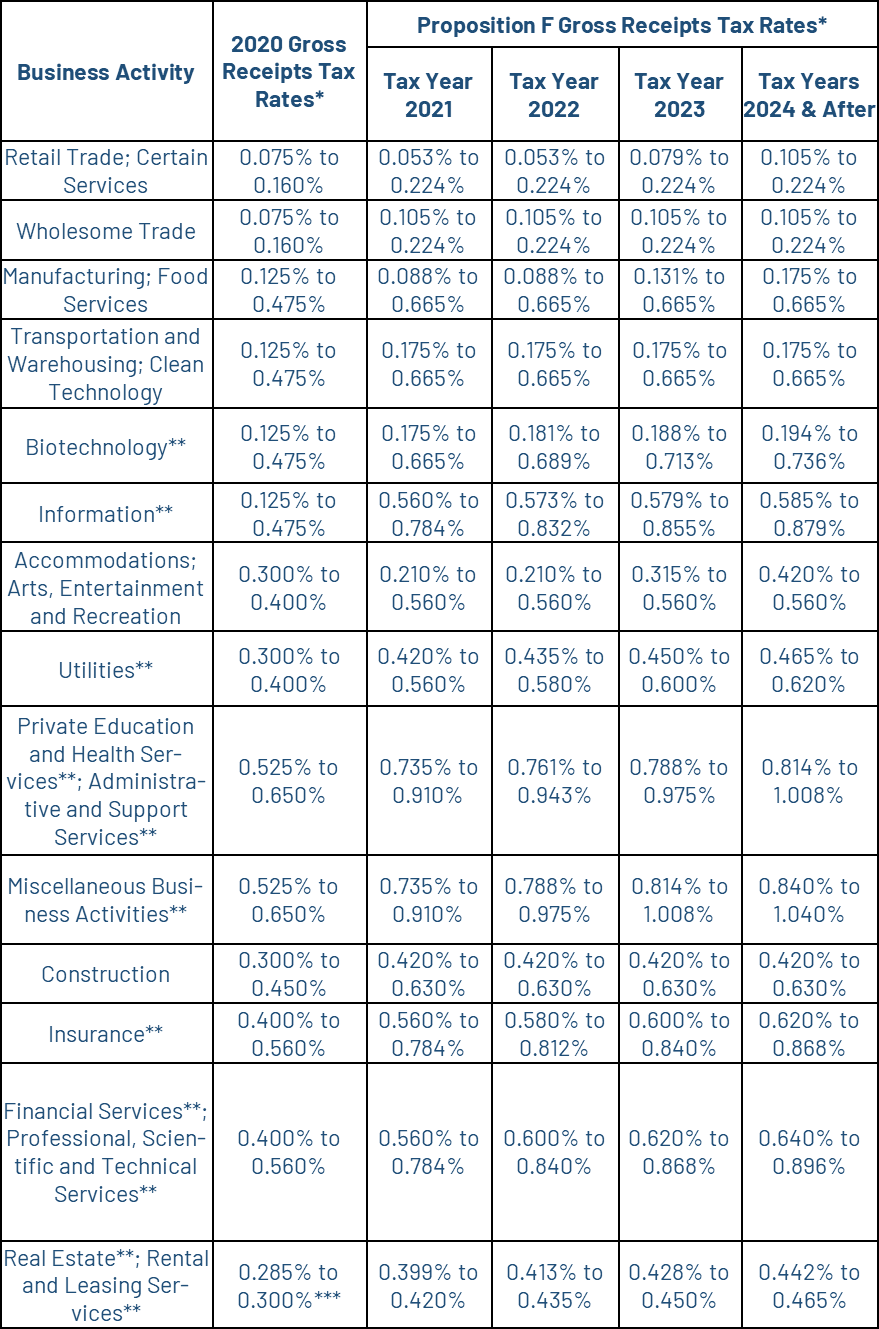

Gross Receipts Tax Gr Treasurer Tax Collector

How Did Merck Record An 11 Tax Rate Last Year The Senate Finance Chairman Would Like To Know Fierce Pharma